Entering 2022, Sri Lanka seems headed towards a full-blown sovereign debt crisis. Recently, major credit rating agencies downgraded the country’s credit ratings—including Fitch, Moody’s, and S&P—indicating that default appears imminent to many observers. Sri Lanka’s debt troubles stem from the culmination of long-running “twin deficits”: the country has run a budget deficit and a current account deficit simultaneously and relies heavily on debt to finance it. Interest payments on debt can be very costly and when maturity periods are short, they can put the country’s finances under immense stress.

The crisis is in part linked to events that have shaken investor confidence. A failed constitutional coup in 2018, followed by the 2019 Easter Sunday Bombings a few months later, and the 2020 COVID-19 pandemic have worsened Sri Lanka’s economic prospects. The electoral victory of populist President Gotabaya Rajapaksa has also led to the implementation of several unorthodox economic policies, reversing previous attempts at fiscal consolidation and further exacerbating Sri Lanka’s volatile economic situation.

The Sri Lankan government cannot simply commit to addressing its immediate debt issues; it must also tackle the deep, structural problems that have plagued the country for decades to ensure that Sri Lanka does not return to such a position in the future once again.

Addressing the immediate debt crisis requires the Sri Lankan government to commit to a debt restructuring program, but it is not in a position to take that action by itself. Therefore, policymakers are exploring support from the International Monetary Fund (IMF), albeit reluctantly. President Rajapaksa has also requested bilateral lenders like China, India, and Japan to cooperate with Sri Lanka to restructure their bilateral debts. The Sri Lankan government cannot simply commit to addressing its immediate debt issues; it must also tackle the deep, structural problems that have plagued the country for decades to ensure that Sri Lanka does not return to such a position in the future once again.

The Current State of Sri Lanka’s Economy

Sri Lanka has had a recent habit of rolling over its debt, using commercial rate borrowings from international financial markets rather than concessional bilateral or multilateral lending. Commercial borrowings have higher interest rates and shorter maturities than concessional borrowings and are therefore more costly forms of debt. With no access to international financial markets since being downgraded and depleting foreign exchange reserves, Sri Lanka must face the inevitable choice of restructuring its debt. Yet, the Sri Lankan government’s policies do not reflect this urgency. For example, its 2022 budget promises a spate of populist “economic relief” programs, more government jobs, and high defense expenditure, racking up a deficit of LKR 1.6 trillion (approximately USD 7.9 billion)—which means the state must borrow once again. Sri Lanka must service USD 4-5 billion of debt every year till 2026.

Sri Lanka also faces the burden of running a significant current account deficit. In response, the government implemented sweeping import bans on the economy, but only 25 percent of its imports are consumables, while the rest of the 75 percent are intermediate and investments goods—like fuel and machinery—that are not easily substituted. The Central Bank’s decision to force an artificially low official exchange rate has driven worker and export remittances away from formal channels, worsening the foreign currency availability. Import bans, arbitrary exchange rates, and low foreign exchange reserves have created difficulties for Sri Lankan businesses to operate at standard capacity.

How Should Sri Lanka Reform its Economy?

The end of Sri Lanka’s civil war in 2009 brought hopes of rapid economic growth, however these hopes did not materialize as Sri Lanka failed to liberalize its economy. The country’s post-war economic growth was mostly driven through government expenditure and large debt-financed infrastructure projects causing Sri Lanka’s budget deficit to increase significantly over time while economic petered off. As institutionalizing fiscal discipline is key to controlling a budget deficit, Sri Lanka should examine and reconstitute the legal, constitutional, and institutional structures to enforce effective budget monitoring, parliamentary oversight, transparency, and accountability.

State intervention in Sri Lanka’s economic activity is high. There are over 500 state-owned enterprises (SOEs) operating in almost every key industry. State-imposed prices have also impeded the development of free markets in the country. Many of Sri Lanka’s SOEs make massive losses due to mismanagement, adding to the government’s deficit and debt problems. Reforming SOEs through divestiture, downsizing, and closure will immediately improve investor confidence and signal that the country is serious about reforms.

The state’s role as an employer has also grown in significance over time. The state employs about 16 percent of the country’s labor force, while another 600,000 former state employees are pensioners. In 2021, the government spent 73 percent of its revenue to pay salaries and pensions for all these employees. Sri Lanka’s state sector is over-staffed and inefficient, posing a large, recurrent burden on taxes. Therefore, reducing state sector employment is essential to reforming the state sector.

Sri Lanka’s GDP per capita has grown from USD $463 to USD $3,680 between 1990 and 2020, but its tax revenue as a percentage of overall revenue has shrunk from 19 percent to 11.5 percent within the same period. Sri Lanka’s tax structure is highly regressive, relying excessively on indirect taxes—including border taxes—to fund government expenses. Regressive tax structures increase income inequality by disproportionately burdening the poor, but income taxes, which are more progressive, constitute only 25 percent of its tax revenues. In 2019, Sri Lankan President Gotabaya Rajapaksa implemented tax cuts that caused a 30 percent reduction in government tax revenue. At the time, this resulted in the worst budget deficit the country had ever seen and eroded its already-low tax base by 33.5 percent. This type of tax regime is woefully inadequate to meet the needs of a nation on its development trajectory, necessitating reforms for a progressive tax structure.

Reforms have been sidestepped so far by successive governments due to their political ideologies and fears of upsetting the status quo, creating the explosive crisis that is currently threatening the wellbeing of their citizens.

Sri Lanka is a highly protectionist economy that relies heavily on import tariffs to protect domestic industries and interests. Sri Lanka’s export composition has also not changed much since the 1990s. Despite entering into several bilateral free trade agreements and benefitting from the US and EU Generalized Scheme of Preferences programs, Sri Lanka has failed to diversify its export basket beyond apparel and tea. Sri Lanka’s openness to trade, which measures merchandise trade as a percentage of its GDP, has fallen significantly since the late 1990s. Trade policy is highly bureaucratized, making it cumbersome to set up and operate import/export-oriented businesses. Transparent and simplified tariff structures on customs, removal of tariffs on raw materials used in production, and improved trade facilitation will improve Sri Lanka’s trade competitiveness and market access and allow, over time, the country to achieve a sustainable current account balance.

The Way Forward

Sri Lanka’s debt situation is overwhelming, and as the country struggles to come to terms with it, the proposed reforms are critical to change for the better. These reforms are tied intrinsically to Sri Lanka’s political economy. Reforms have been sidestepped so far by successive governments due to their political ideologies and fears of upsetting the status quo, creating the explosive crisis that is currently threatening the wellbeing of their citizens. Even if Sri Lanka does manage to address its immediate debt issues, failure to undertake these reforms to control its deficits and outwardly orient its economy increases the chances of Sri Lanka slipping back to a similarly unpleasant state in the future.

***

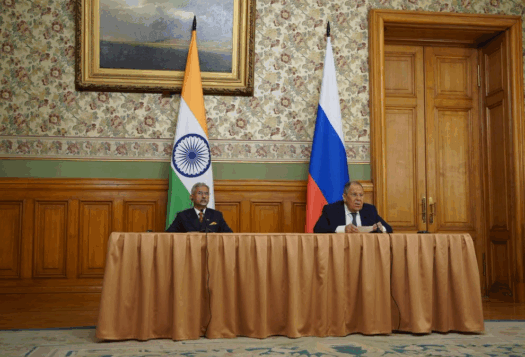

Image 1: McKay Savage via Wikimedia Commons