After decades of political instability, Nepal is finally poised for a stable future with a newly adopted federal structure embedded in its 2015 constitution. The Himalayan nation’s desire for economic growth is natural, as it underwent a decade-long Maoist insurgency, the overthrow of monarchy, and a subsequent political transition. To help Nepal realize its path to prosperity, China has stepped in as a relatively new but formidable ally in trade and investment, challenging India’s prior hegemony in these sectors.

Nepal and China established diplomatic ties in 1955 and their friendship deepened after the Gorkha Earthquake of 2015. That same year, Nepal’s southern neighbor, India, imposed a trade embargo, leaving a landlocked and disaster-stricken Nepal scrambling for fuel and other essential supplies. This created an opportune moment for China to present itself as a benign and supportive neighbor. Although largely a symbolic gesture given the dilapidated state of the existing routes, China began by dispatching a dozen fuel tankers. The move scored geopolitical points for China and paved the way for sending more Chinese firms to Nepal to explore new financing possibilities in hydropower and airport construction, road building, and cement industries.

Beyond benefitting from the infrastructure bonanza, Nepal found an opportunity to show that it was no longer dependent on a single country for essential supplies. Beijing is now a significant player in Nepal’s politics and economy, and Chinese investment in Nepal is expected to usher in a new era for Nepal’s trade and economic enhancement. Nepal, on its part, must create a conducive environment for the development of these two sectors without falling prey to internal political wrangling.

Chinese investment in Nepal is expected to herald in a new era in Nepal’s trade and economic enhancement. Nepal, on its part, must create a conducive environment for the development of these two sectors without falling prey to internal political wrangling.

Overview of Chinese Investment in Nepal

China’s investment in Nepal in the form of foreign direct investment (FDI), humanitarian assistance, and development aid in the recent past has reconfigured the geopolitical relationship between Kathmandu and Beijing. Chinese relief has also been instrumental in emergency and reconstruction phases of earthquake recovery, as it pledged USD $483 million and assisted reconstruction projects, including for historically significant buildings.

The bilateral relation is further exemplified through a series of engagements post-2015. In 2016, Nepal and China signed the Trade and Transit Agreement (TTA). Subsequently, Nepal became one of the first countries to join China’s Belt and Road Initiative (BRI)—the latter’s trillion-dollar-plus ambitious push to expand its global influence. Moreover, since 2018, the two neighbors have been negotiating a number of railroads and transmission line projects. This indicates an increased level of financing over time, as Chinese investment in Nepal was much lower prior to 2015.

The Nepali leadership sees unprecedented economic opportunity in Chinese investment. The signing of the TTA in 2016 held considerable geopolitical and geo-economic implications for Nepal as it sought to break its near complete dependence on India. The TTA allowed for third-country import and export and gave Nepal access to seven Chinese sea and land ports. Similarly, the BRI-led construction of the proposed Kyirong-Kathmandu railroad, worth USD $2.15 billion, is a common reference point vis-à-vis Chinese financing in Nepal. It is also perceived as an attempt to both enhance connectivity and facilitate trade across the region. According to a report by the research lab AidData, Chinese “financial diplomacy” in various infrastructure projects in Nepal, including road and hydropower, was just under USD $1 billion between the years 2000 and 2017.

More generally, China’s investment in Nepal can be understood to fall into one of two categories—state-owned or private. There are stark differences in the way these investments function. State-owned enterprises are largely involved in projects related to critical infrastructures such as hydropower and road construction. It is through such investments that China wants to project its image in the region as an ally committed to spurring economic activity.

On the other hand, investments from private Chinese companies are mainly in micro-enterprises—small shops in major tourist destinations such as Thamel in Kathmandu and Pokhara. Nepal’s tourism sector has also seen a boost with the influx of Chinese tourists. Moreover, in 2019, 170,000 Chinese tourists visited Nepal. However, so far there have only been two big private investments—Hongshi Cement and Huaxin Cement. In 2017, China’s Hongshi Group signed an FDI deal worth USD $359 million with the government and connected with Nepal’s Shivam Cement to build a state-of-the-art cement plant in Nawalparasi in which the Chinese company owns 70 percent stake.

China’s and Nepal’s Investment Goals

As shown above, China has been on an investment spree in Nepal; by extension, the goals of these investments must be analyzed to see whether they facilitate economic growth or merely create conditions of dependency. On the one hand, China has been actively conducting public diplomacy by backing multiple projects related to hydropower, road, hospital, and school construction. It is keen to develop hydro-projects in Nepal to meet its own ends and create a relationship of dependency such that resources flow from Nepal, a peripheral state, to China, a wealthier state.

On the other hand, there have been instances where Chinese companies have backed off owing to financial non-viability—the West Seti Hydroelectric project is a case in point. While the USD $1.2 billion project was meant to be developed by China’s state-owned Three Gorges International, failure to work out the financial modality of the project resulted in its formal termination in 2018. Similarly, in 2017 the government scrapped the agreement with Gezhouba Group for the development of the Budhigandaki Hydropower Project (USD $44.6 million), which was initially a part of BRI.

On Nepal’s part, power generation is expected to create a long-term, lucrative export market for the Himalayan nation. If all goes well, it can transform the government’s financial position by improving national income and making domestic electricity cheaper. Nepal’s internal politics have also played a crucial role in slowing or terminating contracts, as various political parties condemn each other’s policies and actions depending on who is in power and who is in the opposition. For example, the Budhigandaki Hydropower Project has fallen prey to the whims of incumbent governments and their respective policies.

One of the problems plaguing economic growth is Nepal’s tendency to announce big projects without doing proper background research pertaining to costs and long-term consequences of any project. So far, China seems keen to invest in Nepal, but the latter’s lack of clarity on what it wants from an external investor has hindered its ambitions. Even when Nepali leadership discusses the China-Nepal rail community it comes up largely as a rhetorical talking point rather than as a genuine project to see through. The leadership appears unaware as to how it might leverage the railway to enhance cross-border trade—there is a laundry list of products Nepal needs to import, but what it can export remains negligible. Nepal wants rail connectivity as much for geopolitical reasons as economic ones—the leadership sold dreams of a railway with China during the elections in 2017 as an effort to counter its dependency on India for trade. Chinese interest, however, is mostly economic. This incompatibility has inhibited Nepal from fulfilling its aspiration of enhancing connectivity.

Even as China presents itself as a dependable trade and development partner, Nepal must clarify what exactly it wants to gain from China’s newfound interests and ambitions in its development.

Looking Forward: The Future of Chinese Investment in Nepal

Chinese investments and financing have a big role to play in Nepal’s infrastructure goals, but it is up to Nepal to create a conducive environment for success. The political leadership must put aside its differences with opposition parties and work together to usher a new era of infrastructure-propelled development. Despite showing initial interest, private Chinese firms have at times withdrawn when projects are deemed economically inviable. State-owned enterprises, on the other hand, have excelled at public diplomacy by investing in infrastructure projects and providing grants. Even as China presents itself as a dependable trade and development partner, Nepal must clarify what exactly it wants to gain from China’s newfound interests and ambitions in its development.

Editor’s Note: This article is part of the SAV series “Instruments of Influence? Chinese Financing in South Asia,” which analyzes the impact of China’s loans, investments, and financing on domestic politics and geopolitical dynamics in South Asia. The full series can be read here.

***

Click here to read this article in Urdu.

Image 1: Keso S via Flickr

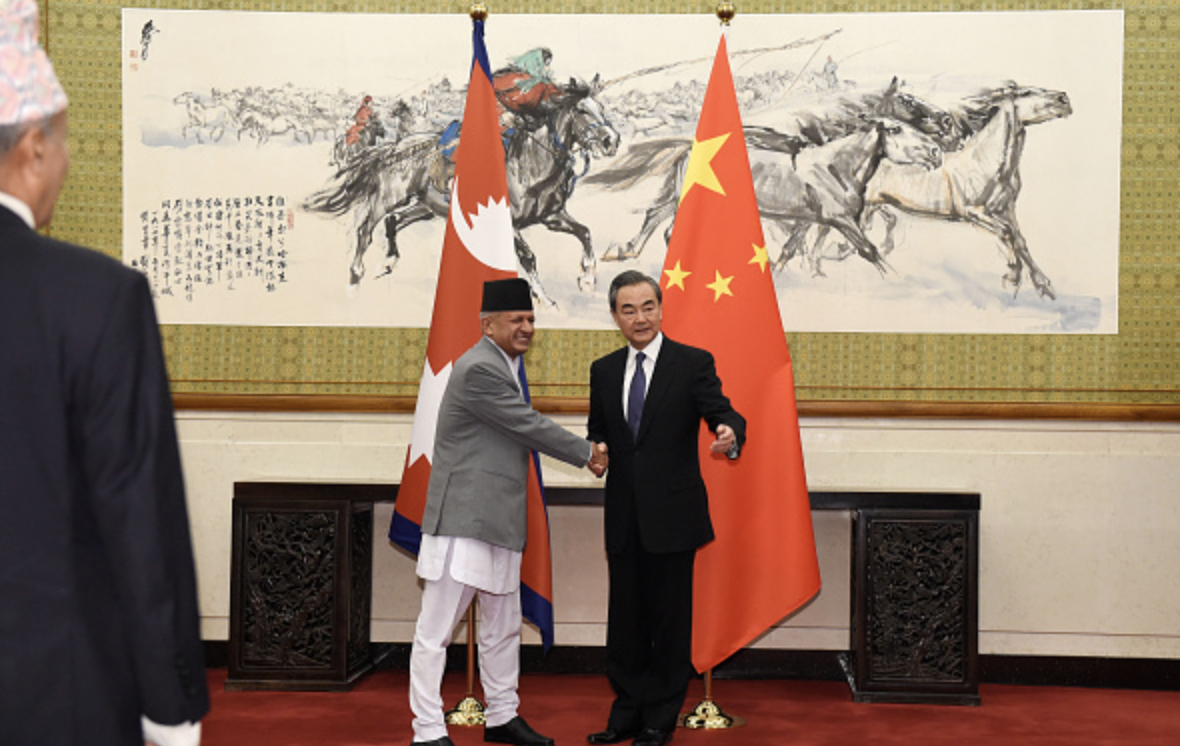

Image 2: Pool via Getty Images