Introduction

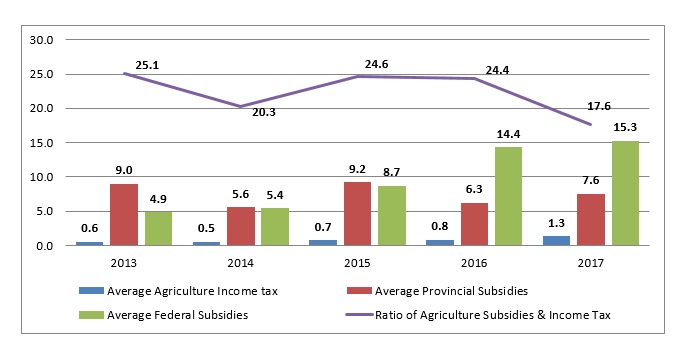

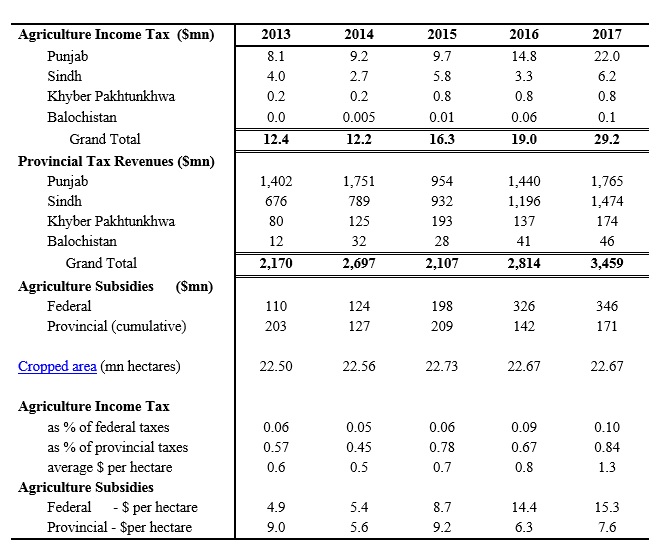

Despite a consistent decline in the relative share contribution of agriculture to Pakistan’s gross domestic product (GDP), the sector has maintained its prominence in the Pakistani economy and continues to ensure food security. Agriculture constitutes one-fifth of the national economy with a nearly 60 percent share in exports and provides a means of living to 42.3 percent of the labor force. However, public policy with regard to the agricultural sector has been disappointing. Despite contributing one-fifth of Pakistan’s GDP, agriculture accounted for less than 1 percent of provincial taxes and 0.09 percent of federal taxes in 2016 (see Table 1). The subsidies in the agriculture sector outweighed the agriculture income tax by a factor of 24 in 2016 (Figure 1), reflecting persistent fiscal indiscipline in Pakistan. To improve their fiscal position, provinces in Pakistan must introduce a fair and equitable system of direct taxation in agriculture, especially for large landowners.

Agricultural Taxation in Pakistan

In Pakistan, the tax performance of both the federal and provincial governments has historically been unsatisfactory. The federal and provincial governments’ increasing reliance on indirect and withholding taxes is an indicator of the state’s failure to tax higher income groups and privileged lobbies to generate revenue. The sub-national governments’ fiscal approach is to substitute taxation with federal transfers, which remains the primary determinant of insufficient provincial and local tax collection today. This has resulted in perpetual deficits and low tax capacities and has consequently increased reliance on debts and foreign aid for development programs in Pakistan. Agricultural taxation in Pakistan is a clear example of the country’s flawed taxation system.

Figure 1: Agriculture Tax and Subsidies in Pakistan ($ per hectare)

Source: Author’s computation from Federal and provincial (Punjab, Sindh, KPK and Balochistan) budgets.

Table 1: Trend Analysis of Agriculture Taxation and Subsidies in Pakistan

Source: Author’s computation from Federal and provincial (Punjab, Sindh, KPK and Balochistan) budgets. The 2017 estimates are budgeted figures.

Note: Average annual exchange rate used for Rupee to Dollar conversion.

During the colonial period, in order to provide an incentive to loyal landlords of the British Raj, the colonial administration granted central taxation exemptions for agricultural income under the Government of India Acts of 1919 and 1935. Pakistan has continued with this legacy under all three of its Constitutions (1956, 1962, and 1973). This exemption affords special protection to the economic interests of privileged land-owning elites, which has added to rural inequality in the agricultural sector. The Agriculture Census of Pakistan 2010 reveals that only 1.1 percent of farms command a total area of 21.6 percent, with each farm larger than 20 hectares. On the other hand, 64.7 percent of farms account for only 19.2 percent of total operational holdings, with each farm less than 2 hectares in size. These numbers demonstrate the stark rural inequality in Pakistan.

Many view the agriculture sector as under-taxed and over-subsidized (see Table 1 above), disproportionately benefitting large farm owners. This is because subsidies are applied per unit consumption, so small farm owners who consume less get less subsidy while large farm owners consumer more units and gets a larger share of the pie. Furthermore, agricultural exemption has resulted in tax evasion, as incomes from other sectors are falsely reported as agriculture income to receive exemptions. This is as per an examination of the archives and reports of the Taxation Commissions of 1959 and 1986 by the author.

Issues and Prospects

Studies on agriculture income taxation in Pakistan by USAID and IDEAS reveal optimal potential for resource mobilization through the agriculture sector, yet there are many constraints to address.

First, not everyone deriving income from agriculture necessarily owns the land. Therefore, credible records of landowner tenures, sharecroppers, and tenants are required. Second, the absence of records on produce and farm gate prices and costs of agriculture inputs are major constraints for calculating taxable income and liability. Average crop yields at farms are monitored by provincial agriculture departments under the Crop Reporting Service (CRS) (Punjab, Sindh, Khyber Pakhtunkhwa and Balochistan) but data on crop income, farm gate prices and costs of inputs is not available. The Pakistan Bureau of Statistics (PBS) and provincial governments do not administer farm gate prices; rather, wholesale, retail, and consumer prices of crops and value added are recorded and publicized. In addition, there is no inexpensive or practical way to verify the agricultural income of individuals; almost nobody keeps records of farm revenue and expenses.

Policy Recommendations

Pakistan can address its flawed agricultural taxation system by implementing a number of policies. A feasible starting point would be to gradually increases taxes on the most privileged 1 percent of farmers, who own over 20 percent of farmlands in Pakistan. As a result, the government would improve its budgetary position and acquire sufficient funds for social protection, input subsidies, price support, and enhancement of irrigation facilities. If the agriculture sector remains untaxed, the persistent strain of subsidies and low revenue may widen the fiscal imbalance.

Provincial governments could use an alternative assessment mechanism of farm-based income to estimate presumptive income. Farm income depends on many factors, including location, fertility of land, crop mix, inputs and technology used, market information, infrastructure, and access to capital. The PBS must then administer the farm gate prices of crops and costs of agriculture inputs during the periodical Pakistan Social and Living Measurement Survey (PSLM). Provincial governments must consolidate and computerize CRS records with provincial Boards of Revenues and obtain individuals’ citizenship records from the National Database and Registration Authority in order to identify a potential tax base. In the second phase, this database should be consolidated with the Federal Board of Revenue’s National Tax Number database so that other business incomes and profits may not be illegally reported as agriculture income.

After development of the above mentioned administrative and institutional framework, the agriculture income may be taxed based on the tax rates applicable to business income under Income Tax Ordinance, 2001. This will ensure equitable treatment for agriculture and non-agriculture incomes.

Reformation of the agricultural tax system in Pakistan will be a gradual process. However, it is a necessary undertaking if Pakistan wishes to improve the fiscal position of its provinces and strengthen its economy.

***