Since the mid-1990s, China has sustained long-term benefits in growth from an export-led manufacturing strategy resulting from a carefully managed exchange rate where the Chinese Renminbi (CNY) remained softly pegged to the U.S. dollar (USD). An under-valued Renminbi helped the Chinese economy to increase its share of world exports from 1.5 percent in 1984 to 14.6 percent in 2015. Japan followed a similar strategy to boost its exports in the decades prior to the 1990s. However, in India’s case, a persistent appreciation—the increase in the value of a currency compared to the value of another stronger currency—of the Indian rupee (INR) in recent years has affected the development of India’s export capacity and the demand for Indian products in both regional and international markets. According to conventional macroeconomics, a higher valued Rupee makes the price of Indian manufactured products and services more expensive in competitive markets. This renders those products and services less attractive to potential importers of those goods. This is especially true for emerging markets, such as those in South and Southeast Asia.

Tracking the history of the last ten years of the USD-INR parity (refer Figure 1 below), one can observe the value of the Indian Rupee as it appreciated against the U.S. dollar. Scholars argue that the current exchange rate reflects an overvalued Rupee. One of the reasons for this trend is increasing confidence in Indian financial markets from foreign investors who, in recent years, have invested heavily in India, in the form of Foreign Direct Investment (FDI) and Foreign Institutional Investment (FII). An increase in foreign investment boosts demand for the Rupee, which results in the value of the Rupee increasing. This higher relative value causes the prices of Indian products in foreign countries to rise over time.

While a strengthening of the Rupee in the short-term indicates a growing confidence among foreign investors in the currency and the growth of its financial market, a more carefully managed exchange rate policy could keep the Rupee competitive. Such reforms are necessary if India’s economic policy aims to promote export-intensive products across all sectors of the economy, including small, medium, and large scale enterprises through policies like Make in India. This is particularly true when compared to other emerging market currencies such as those of China, Brazil, South Korea, and the Philippines, among others.

Figure 1: The Last Ten Years of the USD-INR Exchange Rate

Source: Author’s own calculations from Trading Economics

When analyzing currency values and exchange rates, one usually monitors the trends in the host currency’s nominal exchange rate, which reflects the actual market value of the currency, and the real exchange rate (adjusting the currency value for inflation). If we take 2004-05 as the base year of comparison, both real and nominal exchange rates in the Indian case (seen in Figure 1) reflect a continuous appreciation and overvaluation of INR-USD parity.

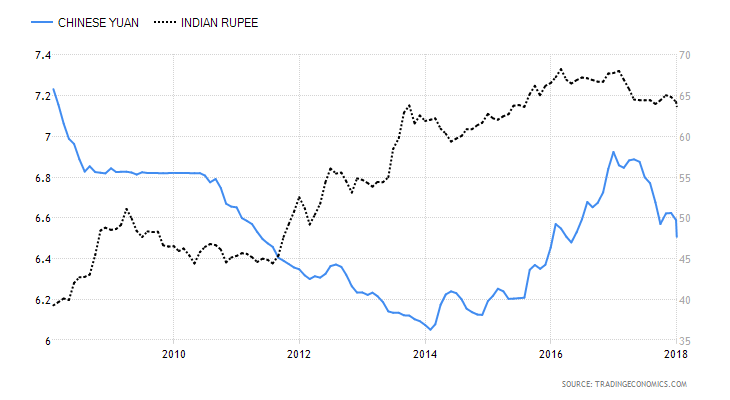

Figure 2: A Ten-Year Comparison of USD-CNY and USD-INR Exchange Rate

Source: Author’s own calculations from Trading Economics

Compared to China (as seen above in Figure 2), we can observe how India’s exchange rate has appreciated over time, while China has managed to maintain an undervalued Renminbi to make its currency (and its products) cheaper and more competitive in export markets. While the underlying factors affecting the volatility of exchange rates may differ from one country to another, it is possible to strategically manage exchange rates and keep them in alignment with the country’s production patterns, as seen in the case of China. This is a good example for countries like India to follow in 2018. Currencies of other emerging countries like the Philippines and South Korea too have seen a drop in their real exchange rate value since 2013, which has allowed their products to become cheaper and more competitive in the global market.

Going forward, it will be vital for both the government and the Reserve Bank of India (RBI) to ensure a more favorable INR-USD exchange rate and keep rising foreign capital inflows in check. One of the key lessons from the East Asian financial crises that occurred in the late 1990s is that a persistent overvaluation of emerging market currency not only affects its trade competitiveness but also makes the country more vulnerable to a currency crisis in the future. In India’s case, a persistent overvaluation has not only affected the export demand, but has also increased the overall cost of goods and services imported from other countries, thereby increasing the country’s overall trade deficit and hampering growth. In November 2017, India’s trade deficit increased to around 13.8 billion USD, the highest deficit since November 2014.

Following the slump in growth caused from the effects of Goods and Services Tax (GST) and demonetization in 2017, gradual reforms in the exchange rate system during 2018 hold the key to improving India’s regional and global trade position. A carefully managed exchange rate with a gradual loosening of monetary policy may allow the Rupee to gradually depreciate while keeping inflation in check. Thus, an undervalued exchange rate system, backed by appropriate policy measures, could be hugely beneficial for India’s economic growth in 2018 and beyond.

***

Image: Sudipto Sarkar via Flickr