Hopeful skepticism among local economists and policymakers has marred the revival of Pakistan’s IMF program. Critics agree that while Pakistan should continue the existing IMF program, Islamabad must also remain cognizant of the reality that the IMF’s Pakistan program lacks the dynamism and flexibility needed for enacting long-term and sustainable reforms. For example, the program would be unable to resolve the country’s economic crisis caused by the recent flash floods that devastated three of its four provinces. Although there is a dubious expectation that the program ushers in macro-fiscal stability in Pakistan, there is also skepticism surrounding Pakistan’s return to the IMF in the future.

Ishaq Dar, a close aide of Nawaz Sharif – the ex-Prime Minister and elder brother of the current Prime Minister Shahbaz Sharif– now heads Pakistan’s financial management. Dar finished a five-year-long exile to be re-appointed Pakistan’s Finance Minister. The experienced chartered accountant has held this position thrice in the past and has adhered to a traditional approach to the economy, which has often manifested in short-term remedial measures to infuse fiscal discipline and prudence. However, after his maiden trip to the IMF headquarters as Pakistan’s new finance minister, Dar and many like-minded economists in Pakistan do not appear hopeful of the IMF program’s utility. Nevertheless, Pakistan is left with limited options but to work with the IMF. Therefore, Islamabad must ensure that the IMF program incorporates local realities and institutes methods to promote self-sufficiency in the long term.

Pakistan and the IMF

Pakistan initiated another round of negotiations with the IMF after the Washington-based financial institution completed the combined 7th and 8th reviews of the seventh extended fund facility (EFF) availed in 2019. Pakistan has approached the IMF 23 times since 1980 when the country entered into its first staff-level agreement with the fund. IMF’s critics in Pakistan continue to disparage the institution’s interventions by citing that the IMF program’s fiscal and external imbalances have often expanded instead of shrinking in many countries. Unfortunately, Pakistan’s case has not been much different. The procyclical movements of the economic indicators have led the country to the IMF every few years, negotiating terms that have increased in stringency and become the subject of contentious political debates.

Although there is a dubious expectation that the program ushers in macro-fiscal stability in Pakistan, there is also skepticism surrounding Pakistan’s return to the IMF in the future.

Pakistan’s economic circumstances vis-à-vis its current account and fiscal deficits keep returning to the juncture where it requires immediate support from the fund to avert default. Meanwhile, the IMF’s structural reform prescriptions and policy support have remained consistent, neglecting the country’s changing policy and economic landscape.

The IMF’s Standard Loan Program

The IMF’s insistence on long-term structural reforms and fiscal consolidation underscores that it is not a temporary bail-out institution. Its policies do not focus on loaning countries out for a certain maturity period and negotiating yet another loan at the commencement of that period. Instead, its programs are conditional upon hardwired structural and policy reforms to support macroeconomic stability and fiscal consolidation. This key distinction between the IMF programs and a standard financial institution or commercial bank relies on both prevention and cure methods to bail out cash and dollar-strapped economies while also preventing them from landing in an analogous situation in the future.

Pakistan has not implemented IMF reforms consistently. This was evident under the Imran Khan-led PTI government as the government diverged from its fiscal consolidation and monetary tightening prescriptions to control rampant inflation. But Pakistan’s economic indicators displayed increasing stagnancy and remained unresponsive to the IMF nudge even when the IMF program was in full swing. IMF progress reports take place periodically but prioritize the achievement of the program conditionalities instead of the program’s overall results. Fiscal and current account deficits continued to expand, bringing the country to the brink of an economic collapse within less than six months of the policy change. This opened the opportunity for the treasury to accommodate higher levels of expenditure demands.

The IMF often makes the same three structural adjustment prescriptions: raising the policy rate (the monetary tightening prescription), rationalizing public expenditure while expanding tax revenues (the fiscal consolidation prescription), and devaluing the local currency to return to a market-based rate of exchange (external account imbalances prescription).

At the onset, the IMF proposals abide by the lessons of free-market and laissez-faire economics. However, when the fund fails to implement sustainable reforms and countries are forced to return to the IMF in a worse situation, economists who design the program at the fund should recreate the three structural adjustment prescriptions.

Unpacking IMF’s Policy Prescriptions in Pakistan

IMF’s policy prescriptions in Pakistan haven’t differed much from the standard IMF structural adjustment prescriptions applied elsewhere in the world. However, for the reasons that follow, these prescriptions don’t seem to align with the structure and functional aspects of the Pakistan economy and hence, haven’t been able to produce the desired monetary and fiscal outcomes.

Firstly, interest rates have little impact on inflation and macroeconomic imbalances because the financial markets in the country have yet to mature. Unlike in the West, where piloting and experimentation of these policies seem to evoke responses in the variables of interest, Pakistan’s financial market operates differently. Instead, assets like houses are bought with cash instead of mortgage financing. In addition, business activity is not predominantly based on commercial loans from banks. Therefore, raising interest rates in Pakistan is not an effective lever to control aggregate demand and consumption; both of which are indicative of expected inflation in the economy.

Secondly, the reduction in development expenditure has negative growth implications; the economy shrinks, business activity stalls, and people lose employment. Even though this is much-needed reform to contain the expanding fiscal deficits, it seems to suffer from reform expediency since cutting discretionary development expenditure is the most convenient reform to institute. However, while expenditure cuts directly impact lowering growth expectations, it has had little impact on containing fiscal deficits. This is because the cuts are often offset by rising interest levels and debt servicing payments that Pakistan starts accruing to the IMF and other multilateral institutions when it enters the fund program.

Thirdly, rupee devaluation should make exports cheaper by allowing Pakistan’s foreign exchange flexibility to finance oil imports without seeking forex support from external lenders. Nevertheless, exports have tended to remain sticky to subsequent rounds of rupee devaluation and have continued to be outstripped by imports. Pakistan’s remittances and exports combined fall short of its import bill; oil imports comprise a large portion of its import portfolio, and have been rising exponentially since the Russian invasion of Ukraine.

The Way Forward for Pakistan

It is uncertain how effective the IMF tranche of $1.17 billion and its conditionalities are in resolving Pakistan’s macroeconomic woes. According to the historical trajectory, a flood-battered Pakistan will stay afloat but likely return to an even stricter IMF program in the next few years. Islamabad must also decide if it sees value in the IMF programs and if it is worth returning to in the future.

While Pakistan does not have any alternate short-term options other than returning to the IMF, it can consider structural reforms, like targeted subsidies and rationalization of current expenditure through fiscal prudence and better management of state resources.

If Pakistan returns to the IMF, it must ensure that the finalized program is responsive to local needs. While Pakistan does not have any alternate short-term options other than returning to the IMF, it can consider structural reforms, like targeted subsidies and rationalization of current expenditure through fiscal prudence and better management of state resources.

Conversations about donor and IMF fatigue are taking place within Pakistan’s academic circles, but the performance of the IMF programs in resuscitating the economy and Dar’s recent visit to the IMF and World Bank convey that the fatigue is on both sides. Nonetheless, despite the fatigue, the IMF program has at least ensured that the default option is off the table and Pakistan successfully averts a Sri Lanka–like situation.

***

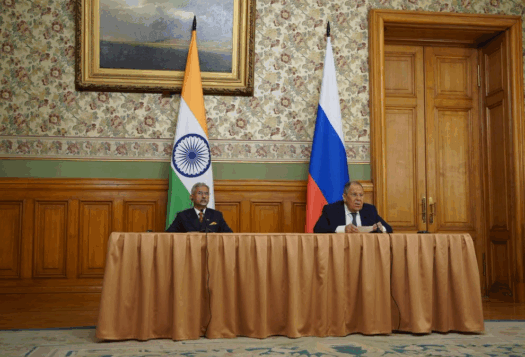

Image 1: Asif Hassan/AFP via Getty Images